(Aachen, Germany) – Hydrogen is an indispensable addition to the world’s secure energy supply. And for a climate-friendly future – at least if the gas is produced with electricity from renewable sources. This has become increasingly clear in recent weeks.

There are different processes for producing hydrogen by electrolyzis. Whereas in the past only highly specialized companies were involved, recently many companies – including newcomers – have been working flat out to improve electrolyzers, make the technology more efficient, and above all: automate the production process to increase throughput and reduce costs.

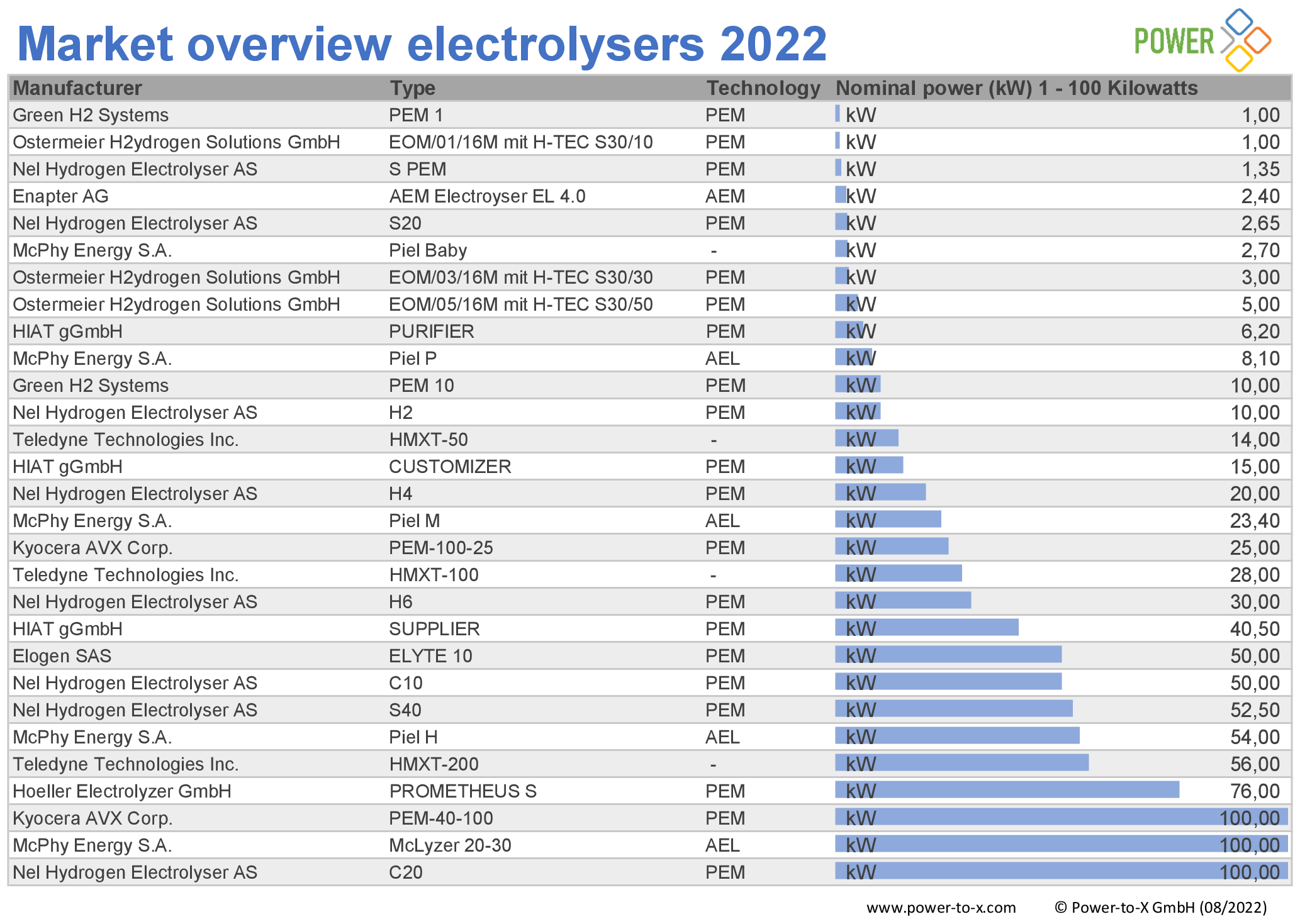

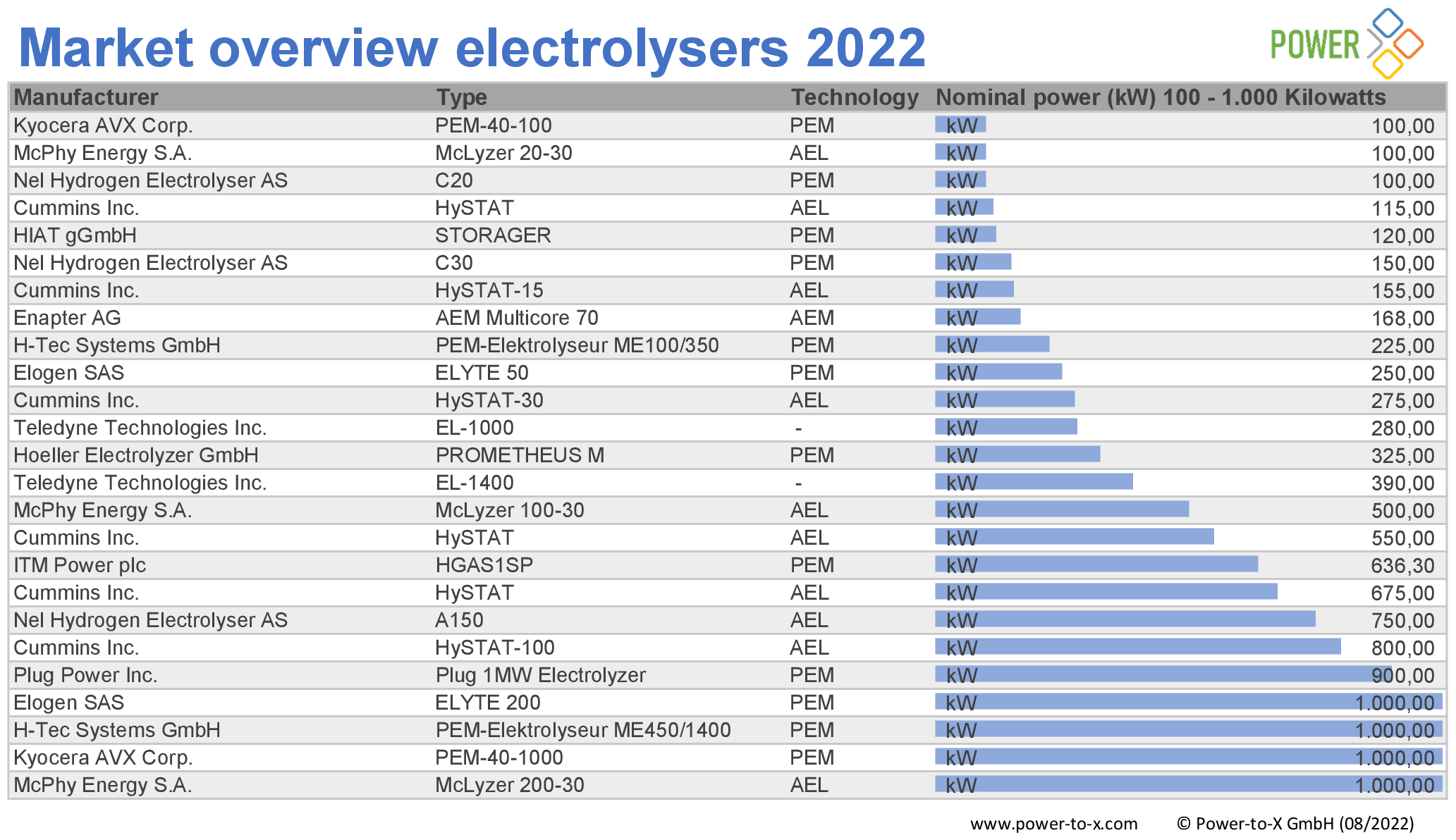

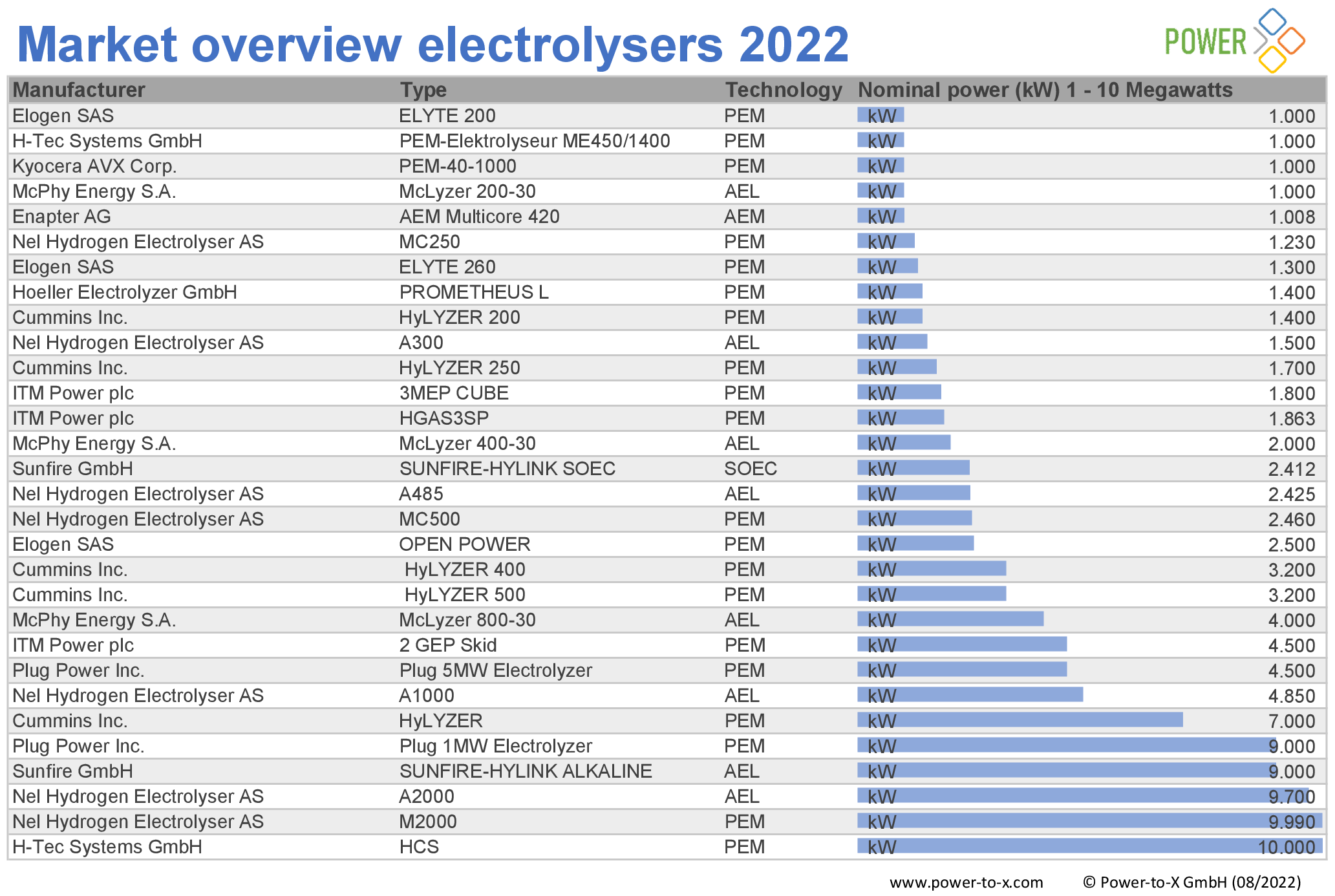

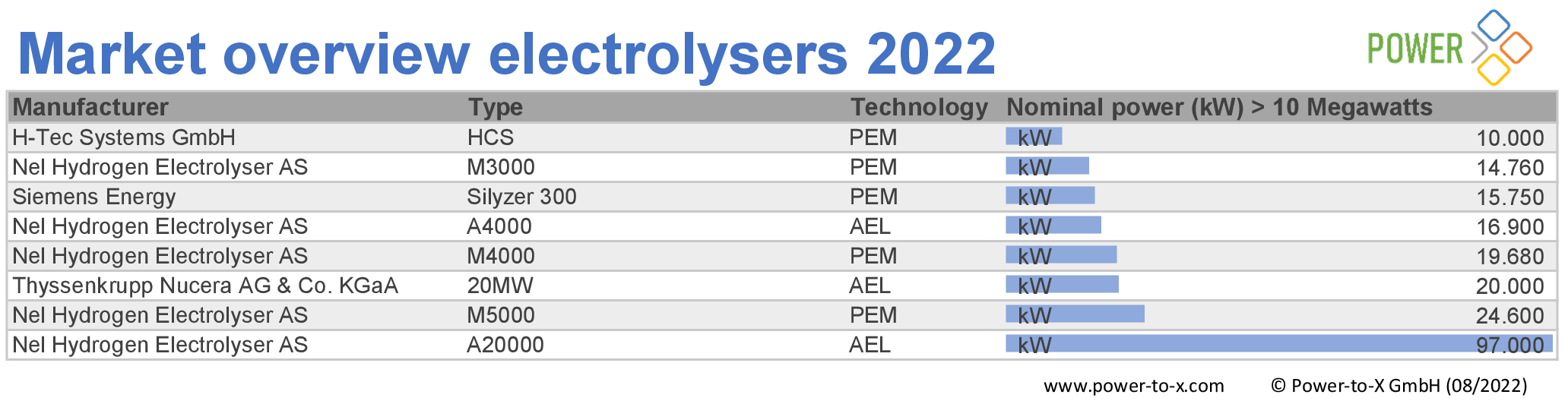

The number of electrolyzer manufacturers is increasing. Our editorial team examined the global offering and compiled the research results in a market overview. We found 92 systems from 17 manufacturers.

All systems were surveyed on the basis of data sheets available on the Internet. If there is no publicly available data, we did not include the product in our list.

Products not directly comparable

As expected, we found different standards, for example in the information on output or generation capacities. This does not make it possible to directly compare the products with each other. We have also dispensed with other detailed information. For example, information on specific yield (in cubic meters) depends on the pressure level. Criteria for the quality of the systems cannot be derived from this in either case.

As the lowest common denominator of comparability, we therefore list the available systems according to nominal output, supplemented by manufacturer, type of electrolyzer and generation type. If no nominal power was given in the data sheets, we calculated it using other available parameters. The market overview covers nominal outputs from 1 kilowatt to 100 megawatts.

Market overview elektrolysers 2022: 1 kW – 100 kW

Download PDF

Market overview elektrolysers 2022:100 kW – 1 MW

Download PDF

Market overview elektrolysers 2022: 1 MW – 10 MW

Download PDF

Market overview elektrolysers 2022: 10 MW +

Download PDF

Four processes in application and research

Four processes in particular are currently being used and tested for electrochemical water splitting:

- The most widely used is alkaline electrolysis (AEL). The technology with industrial applications in plants ready for series production has been around since the first half of the last century: electrodes made of metal are immersed in an aqueous solution, separated by a membrane. By applying a voltage, the water is split into hydrogen (produced at the cathode, negative pole) and oxygen (produced at the anode, positive pole). If the electricity comes from renewable sources, the result is „green“ hydrogen.

- Using the Proton exchange membrane electrolyzis (PEM; Proton Exchange Membrane) or also polymer electrolyte membrane (Polymer Electrolyte Membrane), water is separated into hydrogen and oxygen with the aid of a proton-permeable membrane. The electrodes used are made of precious metal to reduce corrosion in the acidic environment. Research is being conducted primarily to extend the service life of the membrane material used.

- High-temperature solid electrolyte electrolysis (SOEC) is still at the research stage, and industrial applications serve at best to test new scientific findings in practice. According to the manufacturer, the first systems will soon be available. High temperatures of 600 to 1,000 degrees Celsius are required. Adding thermal energy to split the water can reduce power requirements. The electrodes are separated by a ceramic material in a solid oxide fuel cell (SOFC).

- Anion exchange membrane electrolysis (AEM) is currently used worldwide only by Enapter AG, according to the company, which developed the process. The single cell of the plant is divided into two half cells by the anion exchange membrane. Each half-cell consists of an electrode, a gas diffusion layer and a bipolar plate, Enapter said. Several single cells would be interconnected by the bipolar plate to form the AEM stack. This arrangement would allow hydrogen to be produced at a pressure of 35 bar, or oxygen at one bar. The pressure difference between the half-cells prevents the oxygen produced from passing into the high-pressure half-cell, ensuring a very high purity of hydrogen of 99.9 percent.

The two main processes currently in use are AEL and PEM electrolysis. AEL is less expensive on a large scale, hydrogen production is at low pressure levels, but does not have high dynamics. The PEM process is cost effective in small units, but is technologically complex. The membranes are subject to high corrosion and are therefore only moderately durable. The pressure level is high, as are the dynamics. The advantages of PEM technology lie in its easily controllable behavior in the partial load range, making it suitable for mobile use in fuel cells.

Standard cubic meters as a measure

As a result of technological advances, the specific energy requirement for the hydrogen volume flow produced with electrolyzis is falling below 4.5 kilowatt hours per standard cubic meter (kWh/Nm³). As a rule of thumb, the energy requirement is about 5 kWh/Nm³ of hydrogen.

A standard cubic meter is the amount of a gas contained in a volume of one cubic meter at a pressure of one bar. One kilogram of hydrogen is equivalent to 11.1 standard cubic meters. The lower heating value of hydrogen is about 3 kWh/Nm³ or 33.3 kilowatt hours per kilogram (kWh/kg).

Scaling

Systems can be scaled up at will, and vendors excel at multiplying and specifying total output. The list mainly includes individual systems, and only larger scaled systems are shown if a special data sheet is available.

Photo

Bosch is also getting involved in the development of components for electrolyzers and plans to start up PEM pilot plants with smart modules suitable for mass production as early as 2023. © Bosch

The market for electrolyzers is highly dynamic. The industry is announcing new projects, scaling successes and productions everywhere. We will therefore prepare and publish another updated „Electrolyzers Market Overview” in a few months. We invite all manufacturers to send us their data sheets. Participation is free of charge and there are no obligations for either side. Contact: info@power-to-x.de.